Secondary Funds 2.0 — The Evolution of Private Market Liquidity: Diwan Capital - A New Hybrid Between VC and Investment Banking

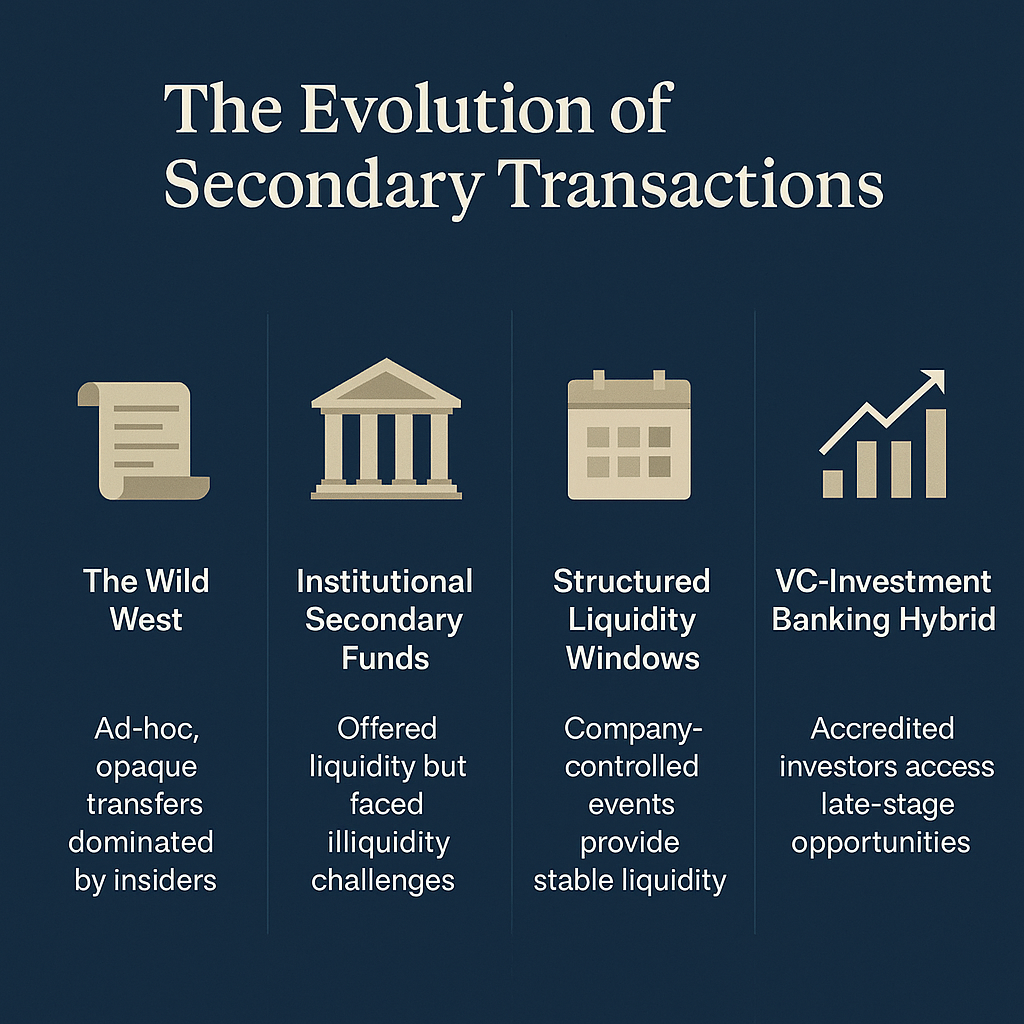

Private market liquidity has undergone a dramatic transformation over the past two decades. What began as a fragmented, opaque, and insider-driven process has slowly evolved into a more structured and founder-aligned ecosystem. In this post, we’ll walk through the key phases in that evolution—from the Wild West of secondary deals to the rise (and fall) of private marketplaces, the emergence of institutional funds, and the advent of structured liquidity windows.

We’ll also explore the latest breakthrough: a powerful hybrid model that blends the agility of venture capital with the precision of investment banking. This new approach is not just solving old problems—it’s working like never before. And it may just be the future of how growth-stage investors and accredited individuals participate in wealth creation before the IPO window opens.

Phase 1: The Emergence of Institutional Secondary Funds

As startup valuations soared and private markets matured, institutional secondary funds emerged. Their strategy was straightforward: buy shares from early investors, founders, or employees, and hold until a liquidity event.

But there was a critical flaw: these secondary funds found themselves trapped on the same illiquid roller coaster as primary investors. They waited years for exits, especially as IPO timelines stretched longer—particularly in emerging markets. Secondary funds faced additional pressure from LPs expecting quicker turnarounds due to shorter fund lifecycles.

Phase 2: The Rise and Fall of Private Stock Markets

To provide liquidity, private stock marketplaces attempted to bridge the gap. Almost all failed spectacularly. Why?

Founders resisted fiercely—these platforms threatened their control over pricing, cap table integrity, and governance. The recent collapse of platforms like Sandhill Markets, Linqto, and many others, underscores a harsh reality: liquidity solutions that are misaligned with founders' interests are doomed to fail.

Phase 3: Company-Controlled Structured Liquidity Windows

The industry finally discovered the winning formula—structured, periodic liquidity windows, controlled entirely by the companies themselves.

In this innovative model:

Companies set the terms: They decide pricing, timing, sellers, and buyers.

Cap table stability is preserved: No random investors, no surprises.

Governance and compliance: Every transaction aligns with legal and governance standards, eliminating backdoor dealings and disputes.

This structured approach creates a genuine win-win-win scenario:

Shareholders gain fair, regular liquidity.

Founders retain control and transparency.

New investors gain access to top-tier late-stage opportunities.

Why Structured Liquidity Matters in Emerging Markets

This innovation is especially crucial in rapidly evolving markets like MENA, the fastest-growing emerging region today. The IPO successes of companies like Talabat and Jahez signal deep investor demand. Yet, post-IPO returns quickly stabilize, leaving little excitement for investors entering late.

Increasingly, sophisticated investors recognize real wealth creation happens pre-IPO. Structured liquidity windows are becoming a key vehicle for capturing this pre-IPO upside, providing meaningful returns without the traditional long-term lockup.

The Reality for Founders, Employees—and Early Investors

Despite the proven benefits, some VCs still resist secondary sales, arguing that it threatens alignment with the mission or long-term commitment. But the truth is more complex:

Founders and employees have real-life financial needs—homes, families, even accumulated debt. Blocking secondary sales often just pushes these transactions underground, creating friction and mistrust. The most progressive VCs understand this and support structured secondaries, helping founders de-risk. Those who resist risk their reputations—founders talk.

Even on the founder side, there was initial resistance to letting early angels or VCs sell secondaries. The fear: it would send a negative signal—maybe the company isn’t doing well, or the investor is abandoning ship, potentially hurting the next fundraise. But reality sets in: early angels and VCs are sometimes simply hitting their target returns—10x, 20x, or more—and want to recycle capital into new projects. Or their fund term is ending and they must return cash to their LPs. A transparent, founder-approved liquidity window solves for all parties. It turns what could have been a red flag into a sign of a healthy, maturing company—one where early backers can exit successfully, and new strategic investors can join for the next leg of growth.

Phase 4: Secondary Funds 2.0 — Venture Capital Meets Investment Banking

From these insights emerged a new hybrid secondary fund model, combining the best elements of venture capital and boutique investment banking:

Direct underwriting (buy): Funds purchase secondary shares directly from founders, early employees, or investors at negotiated fair discounts.

Single-company SPVs (hold): Shares are rolled up and warehoused in Special Purpose Vehicles (SPVs), typically held for 2–3 years, waiting for a valuation uptick, a new round at a higher valuation, Not an acquisition or an IPO.

Short-term exits (sell): After the holding period, funds exit by offering accredited retail investors shares in the SPV, gaining direct exposure to high-growth companies, coordinated closely with the company. (or sell at the next round to new primary VCs who want to purchase secondaries to reach a target ownership percentage)

This model offers unparalleled speed and returns:

Shorter investment cycles: Quick capital recycling and shorter fund lifecycles.

Enhanced returns: Traditional VC funds rely on investing in multiple companies, typically 20 or more, hoping for at least one 50X homerun to achieve 2–3X total fund returns and 20–30% IRR over an 8-year horizon. In contrast, this new model's entry discounts combined with valuation growth can achieve a similar or superior return profile with significantly lower risk, often doubling capital within a few years per deal, targeting a steady 2X total fund return and comparable IRR in a 4-year horizon.

A New Opportunity for Accredited Investors

Retail investors realized that wealth is made before the IPO not after. This innovative approach opens doors for accredited retail investors, providing them access to clean, compelling pre-IPO investment opportunities previously unavailable unless they were LPs in traditional VC funds.

Even then, LPs typically face a mixed portfolio of investments—some winners, some disappointments—without direct choice or control. The new model empowers investors to handpick attractive pre-IPO opportunities, granting greater autonomy and aligning perfectly with their individual investment strategies.

Solving the Liquidation Preference Issue

Historically, secondary buyers feared dilution or being washed out by subsequent investment rounds and aggressive liquidation preference stacks. Today, by targeting mature, IPO-ready companies, these liquidation preferences disappear at IPO, as shares convert equally to common stock. This approach removes traditional secondary market risks, creating cleaner exits and true alignment between companies and investors.

Even when working with earlier-stage companies that may not yet have a clear IPO path, we structure deals to protect our investors. By negotiating favorable liquidation preferences or downside protections on their behalf, we ensure their exposure is mitigated while maintaining alignment with the company’s long-term growth trajectory.

Managing Drag-Along and Tag-Along Concerns

Structured liquidity windows are designed not only to offer fair pricing and clean exits—but also to respect governance and shareholder rights. Since liquidity windows are basically company-led tender offers, participation is fully optional.

While our preference is to buy from founders and early employees, existing VCs and early backers can also sell portions of their stake if there's interest from buyers. Each window is structured with clear caps on how much any individual shareholder can sell, preventing bulk sales that could trigger tag-along or drag-along rights.

This ensures liquidity is made available without disrupting ownership dynamics or forcing anyone into an unwanted exit. Investors can choose to sell at the offered price—or wait for a future window if they expect further upside. The key is flexibility, fairness, and firm alignment with company governance.

Diwan Capital: Pioneering the Future of Private Market Secondaries

At Diwan Capital, we're pioneering this new approach by underwriteing secondaries:

Buy shares from founders, early employees, & angel investors at a discount, to provide immediate liquidity, & roll those shares into an SPV,

Hold those shares until the next round or until a valuation uptick,

Sell fractional ownership of the SPV to accredited retail investors, utilizing an investment banking license, or sell to new primary VCs who have a target ownership percentage.

We're not a marketplace or a traditional secondaries fund; instead, we're a hybrid, built around founders' needs and investor outcomes. Our model ensures compliance, cap table stability, and real value creation.

Curious about how structured liquidity could benefit your company, your team, or your investment strategy?

We're always eager to connect with forward-thinking investors and founders who believe in the future we're building. Reach out, and let's discuss how we can reshape private market liquidity together.

The next chapter in private markets is here—and it’s built to work for everyone.