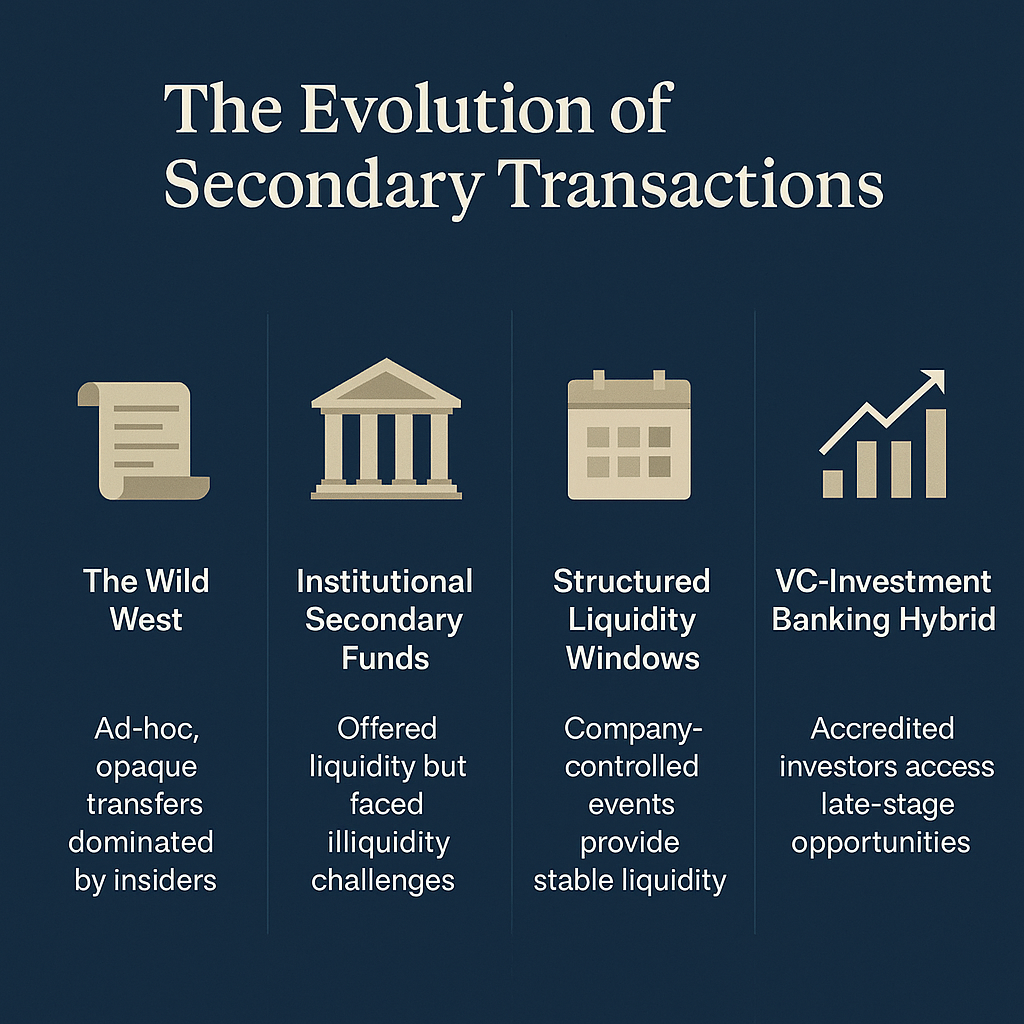

Secondary Funds 2.0 — The Evolution of Private Market Liquidity: Diwan Capital - A New Hybrid Between VC and Investment Banking

At Diwan Capital, we're pioneering this new approach: We underwrite and acquire secondary shares at fair discounts, then we hold shares through critical valuation inflection points, and finally we partner with companies to open structured liquidity windows for sophisticated investors.

Can Modern VC Firms Be Considered “Money Managing” Startups?

Recently, I’ve noticed more GPs treating their VC firm like a startup, raising a pre-seed round to build what is essentially a "Money Management" startup. Their product? Managing syndicates, venture funds, secondary funds, venture debt products, evergreen vehicles, you name it.